When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment. Do you know how much you might pay for property taxes? We can help!

When applying for a mortgage, you’ll see one of two acronyms in your paperwork – P&I or PITI – depending on how you’re including your taxes in your mortgage payment.

P&I stands for Principal and Interest, and both are parts of your monthly mortgage payment that go toward paying off the loan you borrow. PITI stands for Principal, Interest, Taxes, and Insurance, and they’re all important factors to calculate when you want to determine exactly what the cost of your new home will be.

TaxRates.org defines property taxes as,

“A municipal tax levied by counties, cities, or special tax districts on most types of real estate – including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.”

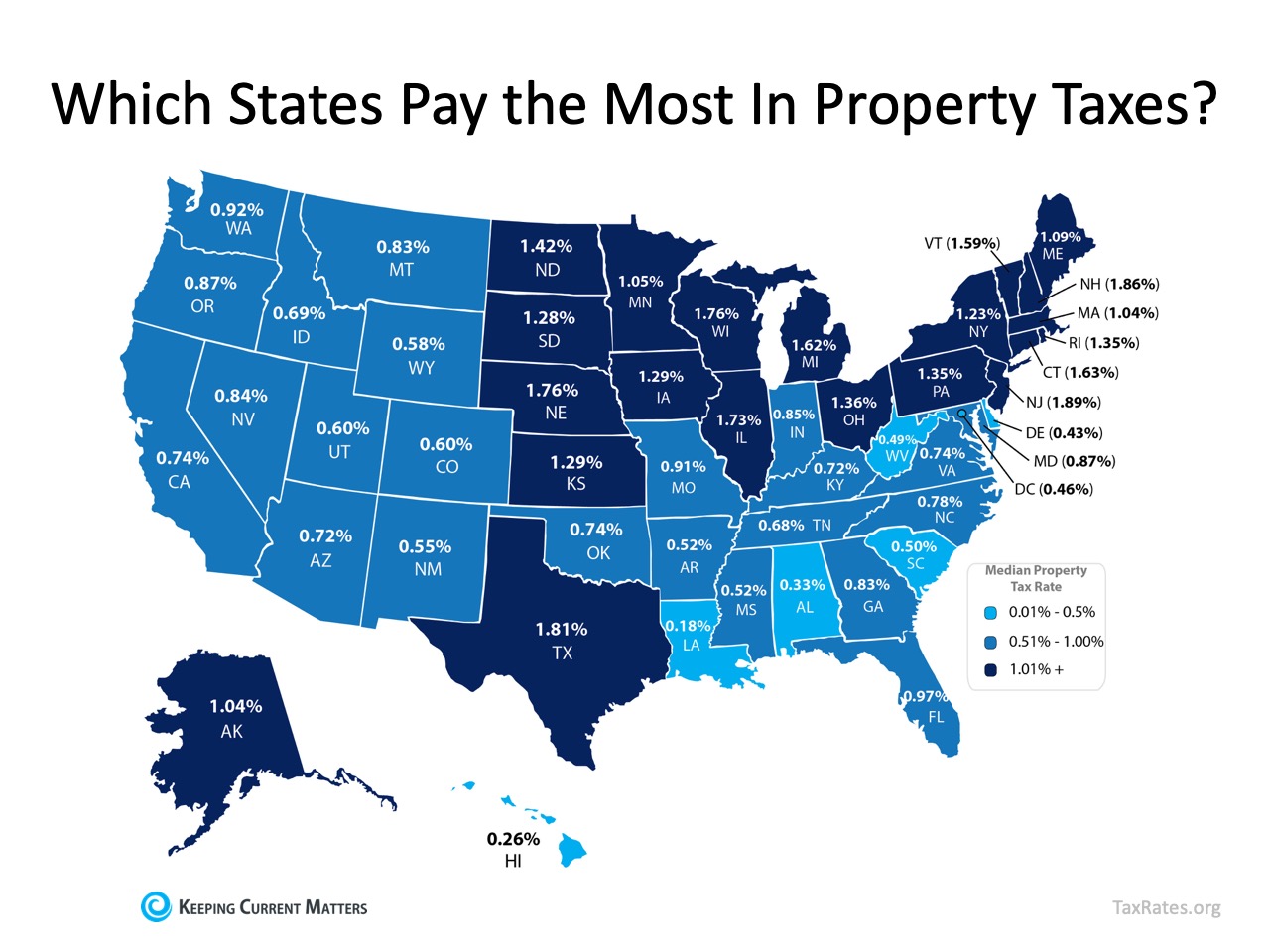

This organization also provides a map showing annual property taxes by state, from lowest to highest, as a percentage of median home value.

Bottom Line

Property taxes can have a big impact on your monthly payment. To make sure your estimated taxes will fall within your desired budget, contact Team Fraker today to find out the average taxes for the neighborhood or area you are looking. This can make a difference in your overall costs when buying a home.

- How AI Virtual Staging Helps Homes Sell Faster (Without Expensive Renovations)

- The Most Effective Way to Build Wealth Using Real Estate (That Most People Overlook)

- Accept, Counter, or Reject: Navigating Your Home Sale Offer

- Why Tennessee Was the Top Choice for Moving States: Top Four Reasons Revealed!

- Pros and Cons of Living in Murfreesboro, Tennessee (Complete Guide)