Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.

Home equity is defined as the difference between a home’s fair market value and the outstanding balance of all liens on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value increases.

Today, the number of homeowners that currently have significant equity in their homes is growing. According to the Census Bureau, 38% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 54.5 million homes with a mortgage, 26.7% of them have at least 50% equity. That number has been increasing over the last eight years.

CoreLogic also notes:

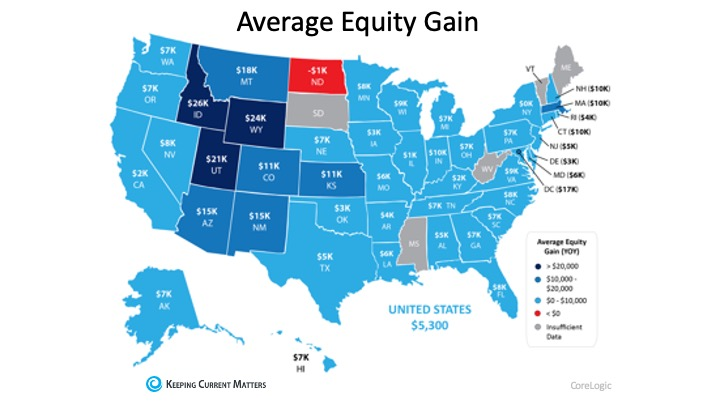

“…the average homeowner gained approximately $5,300 in equity during the past year.”

The map below shows a breakdown of the increasing equity gain across the country, painting a clear picture that home equity is growing in nearly every state. TN is in the $10,000 and under range. If you would like to know the value of your home, reach out, and I'm happy to pull comps to see what prices are going in your neighborhood. From there you just subtract what you owe from that number and that equals what you have in equity.

Bottom Line

This may be the year to take advantage of your home equity by applying it forward, either as you downsize or as you move up to a new home. We have clients using their equity as a down payment to move up in home, to move down in home and pay off debt, to add a swimming pool, etc. Lots of options here!

- How AI Virtual Staging Helps Homes Sell Faster (Without Expensive Renovations)

- The Most Effective Way to Build Wealth Using Real Estate (That Most People Overlook)

- Accept, Counter, or Reject: Navigating Your Home Sale Offer

- Why Tennessee Was the Top Choice for Moving States: Top Four Reasons Revealed!

- Pros and Cons of Living in Murfreesboro, Tennessee (Complete Guide)